Calculate interest on loan

What is interest

When you take out a loan, whether it’s a car loan, home loan or amount on a credit card, you’ll have to pay back both the amount you borrowed and interest on top of it. But what do we mean by that?

Essentially, interest is a fee you pay for using someone else’s (usually the bank’s) money. It’s how lenders make profit from giving out loans – after all, they’re not in it out of the goodness of their hearts.

Usually the repayments you make on a loan will be made up of two parts: the part that reduces your balance to pay off your loan, and the part that covers the interest on the loan.

Factors that affect how much interest you pay

You’ll need to know a few basic facts about your loan before calculating how much interest you’ll pay. All of these things should be freely available to you before you take on the loan, and it’s a good idea to know them all, even if you’re not trying to calculate interest.

Principal amount

This is the amount you’re looking to borrow. But it’s not as simple as deciding how much you want – you should really be focusing on how much you can realistically afford to pay back.

To work it out, consider your budget on all levels – yearly, monthly and weekly – and think about any life changes you might encounter, like having kids or moving house. Mozo also has some great, free resources to help you straighten out just how much you can borrow, like our:

Loan term

How long will you be repaying your loan? Shorter loan terms will generally mean higher repayments, but less interest in the long run. Longer terms will lower monthly repayments, but cost more in interest over the life of the loan.

For example, our personal loan repayment calculator shows that on a loan of $20,000 at 8.75% p.a. you would pay:

- $634 each month, adding up to $2,812 in interest over 3 years, or

- $413 each month, adding up to $4,765 in interest over 5 years.

Repayment schedule

On many loans, you’ll have the option to make repayments weekly, fortnightly or monthly. Which one you choose will depend on your budgeting style.

More repayments means less interest, because of the effects of compounding, so weekly repayments will save you some money. But before you commit to a weekly repayment schedule, make sure your budget can meet it.

Repayment amount

When you make your repayment, not all of it goes to paying off your loan, as such. A certain amount will go towards paying the interest first and then what’s left chips away at your loan principal. Because the amount of interest you pay depends on what your principal is, to calculate ongoing interest costs, you’ll need to know what amount you’re making in repayments.

Interest rate

When calculating interest on your loan, remember to use the basic annual interest rate and not the comparison rate to get accurate numbers. The comparison rate takes into account fees and charges as well as interest, so if you use it, you will get a higher amount of interest than you should.

Calculating interest on a car, personal or home loan

These loans are called amortizing loans. The mathematical whizzes at your bank have worked them out so you pay a set amount each month and at the end of your loan term, you’ll have paid off both interest and principal.

You can use an interest calculator to work out how much interest you’re paying all up, or, if you’d rather do it by hand, follow these steps:

1. Divide your interest rate by the number of payments you’ll make in the year (interest rates are expressed annually). So, for example, if you’re making monthly payments, divide by 12.

2. Multiply it by the balance of your loan, which for the first payment, will be your whole principal amount.

This gives you the amount of interest you pay the first month.

So for example, on a personal loan of $30,000 over a period of 6 years at 8.40% p.a. and making monthly repayments:

.jpg)

Because you’ve now begun to pay off your principal, to work out the interest you pay in the following months, you need to first calculate your new balance. So:

1. Minus the interest you just calculated from the amount you repaid. This gives you the amount that you have paid off the loan principal.

2. Take this amount away from the original principal to find the new balance of your loan.

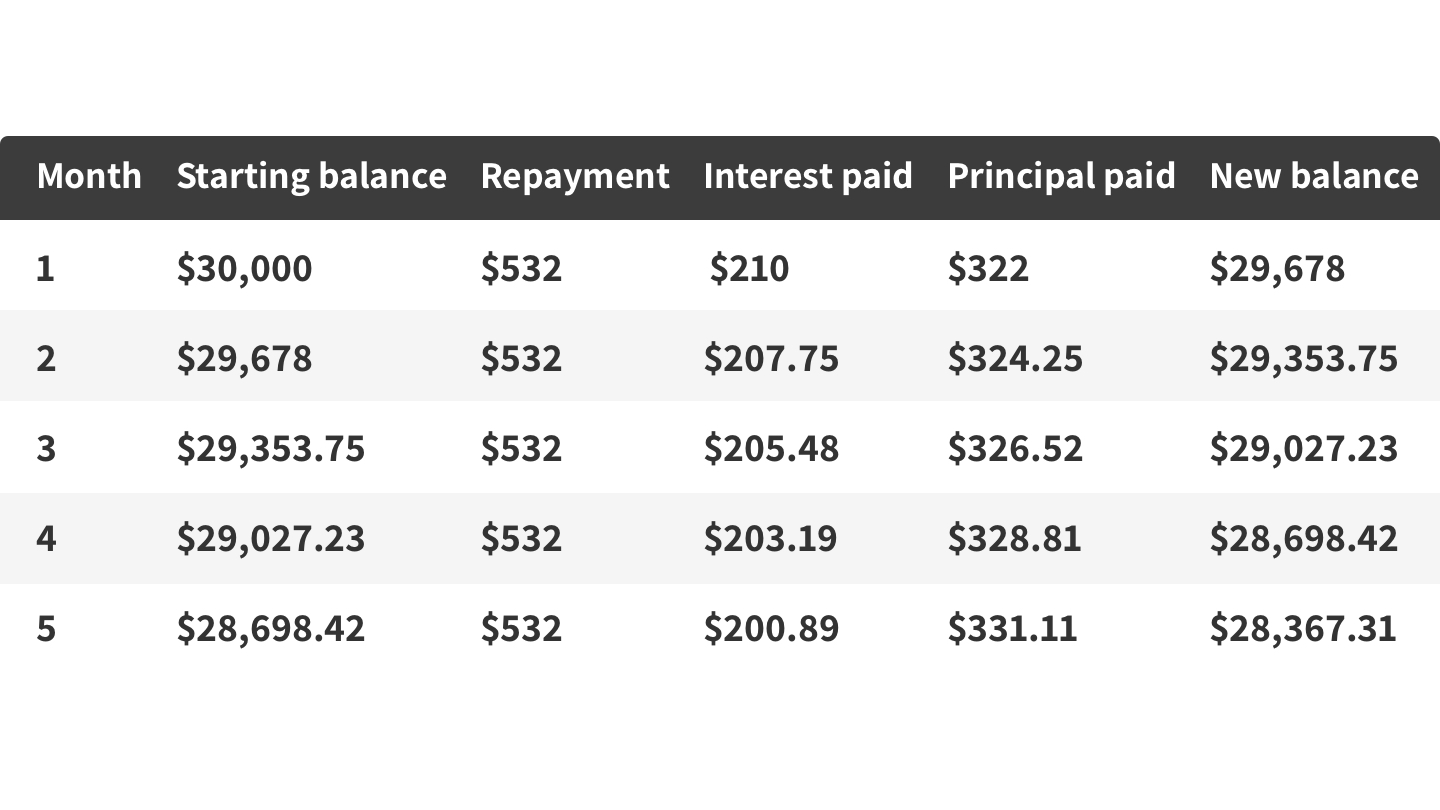

To work out ongoing interest payments, the easiest way is to break it up into a table. So using the above example, your calculations might look like this:

Keeping in mind that doing the calculations yourself means slight discrepancies due to rounding and human error, this should give you a pretty good idea of what you’re paying in interest each month.

Interest-only loans

Taking out a home loan? You might have the option to choose between a principal and interest loan or an interest-only loan.

As the name suggests, if you choose to take out an interest-only loan then your whole monthly payment will be going toward interest. You won’t be chipping away at your principal amount, which means the amount of interest you pay won’t change.

In the above example, you’d pay only $210 in interest each month, and then at the end of the 6 years, you’d have a lump sum of $30,000 to pay in full.

Calculating interest on a credit card

It’s a good idea to think of using a credit card as taking out a loan. It’s money that is not yours, you’re paying to use it, and it’s best that you pay it back as soon as you can.

For the most part, working out how much you pay in interest on your credit card balance works much the same way as for any other loan. The main differences are:

- Your basic repayment is a minimum amount set by your credit card company. It might be a set dollar amount, similar to any other loan, or it might be a percentage of your balance. It’s best to pay more than the minimum amount, because often, it doesn’t even cover the cost of interest. Paying only the minimum is how you wind up with a massive credit card debt.

- If you make purchases on your card before paying off previous amounts, it will be added to your balance and you’ll pay interest on the whole lot. This will change your minimum payment amount as well, if the minimum payment is based on a percentage of your balance.

It’s always a good idea to pay off as much of your credit card balance as you can, as early as you can. This way, you avoid getting hit by high interest rates.

So when you’re calculating your interest, just remember to use the right amount for your repayment value and add any extra purchases onto your balance, and the above method should work to calculate your interest.

Use our interest rate calculators

If all of that looks like way too much math to stomach, or if you don’t have time to become a spreadsheet expert, you can use our handy financial calculators to do the work for you.

Our repayments calculators will tell you the repayment you’ll make on a monthly, fortnightly or weekly basis, and give you the total amount of interest you’ll wind up paying on your car, personal or home loan. And our credit card debt payment calculator will show you how long it will take you to pay off a credit card debt, plus how much you’ll pay in interest and fees.

Interest rate FAQs

How does the cash rate affect commercial interest rates?

The cash rate reflects the market interest rate on funds banks lend and borrow from each other overnight. It is set by the Reserve Bank of Australia (RBA), which meets on the first Tuesday of every month (save for January) to discuss any potential moves.

But what does this have to do with commercial interest rates? Simply put, the cash rate serves as a benchmark rate for savings accounts and variable rate home loans. When the RBA raises or lowers the cash rate, banks and lenders tend to modify their own home loan and deposit interest rates soon after.

Why do interest rates change?

There are a number of things the RBA will take into account when deciding whether to change the cash rate. Chief among them are domestic conditions, such as employment and inflation, though global financial conditions are also important.

If the economy is booming and high demand is pushing up prices, the RBA might increase the cash rate to make sure inflation doesn’t spiral out of control. And if the economy is weak and demand is low, the RBA might decrease the cash rate to encourage spending, borrowing and investment.

Why do banks charge different interest rates?

While the cash rate is one of the main things banks will consider when setting commercial interest rates, it’s not the only one. Banks will also be keeping an eye on overhead costs, as well as maintaining a healthy margin between the loan and deposit rates they’re offering.

Generally speaking, online banks tend to offer cheaper home loan rates and more generous savings account rates than their larger counterparts, as they have fewer overhead costs to worry about. The flipside to this is that larger banks tend to offer more when it comes to physical branches and face-to-face services.

Do all interest rates move in line with the cash rate?

Fixed home loan rates and term deposit rates are not tied to the cash rate in the same way that variable rate products are. While they may seem to move in line with the cash rate, they’re more so a reflection of how the economy is faring.

It’s more accurate to say that rates like these are influenced by government bonds. By buying up government bonds with the aim of driving down medium term fixed rates, the RBA effectively pushes fixed mortgage and term deposit rates lower.

How can I find the best interest rates?

Whether you’re looking for somewhere worthwhile to put your savings or you’re thinking about taking out a mortgage, it pays to have a sense of where interest rates currently sit. If you’re unsure what’s out there, our comparison pages are a good place to start.